On our inaugural Nature Day, food was high on the agenda, as industry experts explored how global food systems can be at the forefront of building a nature-positive economy by converting industrial monocultures into regenerative farms. ‘Regenerative commodities’ – those produced in harmony with nature, rather than at its expense – will lead the biggest economic revaluation of the next 100 years. Agricultural land will go from carbon source to carbon sink, creating new revenue streams for investors.

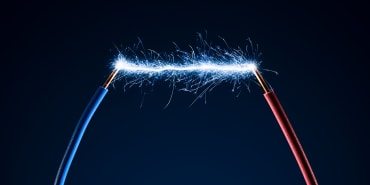

Industry day focussed on the exponential growth of electrification, as the world’s energy systems rapidly shift from fossil fuels to clean, renewable energy – and on the transition chain reaction this shift is kickstarting across all sectors. The built environment – the world’s biggest asset class – lags all other major sectors in the race to net zero. As regulations begin to impose emissions reduction targets across real estate, and as electrification creates new opportunities to improve buildings’ energy efficiency, investors have an unprecedented opportunity to both benefit from, and drive, the transition to a net-zero economy.

At Lombard Odier, we position ourselves to capture the investment opportunities surrounding the transition to a Circular, Lean, Inclusive, and Clean (CLIC®) economy – an economy that puts nature at its centre. We believe that nature is the most transformative technology on Earth. Only healthy and resilient ecosystems can be effective carbon sinks at the scale needed, and biodiversity is the key measure of our planet’s health. Nature-based solutions, including the protection, restoration and sustainable management of our land systems, provide an opportunity for investors to diversify portfolios and minimise their portfolio climate-risk. Innovations in nature-based real assets will help investors realise green alpha while playing a key role in boosting biodiversity and driving the transition to a nature-positive economy.

Nature-based solutions, including the protection, restoration and sustainable management of our land systems, provide an opportunity for investors to diversify portfolios and minimise their portfolio climate-risk

COP28 was a chance for us to help galvanise action around nature-based solutions, food systems, industry decarbonisation, and infrastructure, while showing investors how developments in these areas will create a net-zero, socially just, nature-positive economy. Because nature is worth investing in.

share.