rethink sustainability

We only have one planet: it’s up to everyone to protect it

The problems of climate change and pollution seem to be growing increasingly urgent every day. Pressure is mounting on companies in the most exposed sectors, with environmental NGOs, states and investors in particular bringing their voices to bear. We seem to have passed the denial phase of climate change now, and awareness is growing worldwide. The ultimate challenge remains: ordinary citizens, companies and the world of finance need to learn to act sustainably.

Every year, the NGO Global Footprint Network calculates and publishes what it calls “Earth Overshoot Day”: the date on which humanity’s resource consumption for the year exceeds Earth’s capacity to regenerate those resources that year. Every year without fail, Overshoot Day comes earlier than the one before. In 2018, it was on 1 August. In other words, we are consuming 1.7 planets’ worth of resources, but we obviously only have one!

The methodology of this publication is sometimes disputed, but it has considerable media impact. Moreover, it helps to draw attention to the precarious nature of humanity’s current development model.

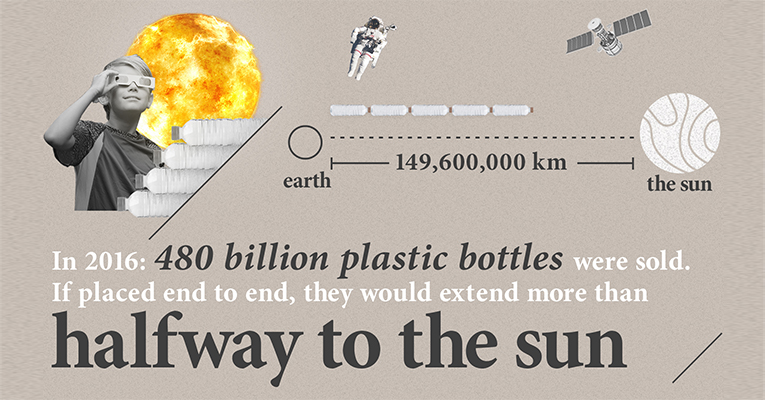

Human activity is having a huge environmental impact, which continues to increase. This is borne out by another impressive figure: the world’s population will grow by an average of 180,000 inhabitants per day until 2050, the equivalent of a city the size of Reims or Geneva. And all these extra people will need a roof over their heads, clothes, transport... and water. One of the many consequences of this situation is that the global production of plastic bottles for the drinks sector will have shot up by more than 20% by 2021 from its already astronomical level of 480 billion per day in 2016, according to the research institution Euromonitor.

One environmental risk may conceal another

A move towards a less environmentally damaging economic model is all the more urgent given that one danger may sometimes conceal another one. It’s easy to understand that polar ice caps melting impacts sea levels. The experts on the Intergovernmental Panel on Climate Change (IPCC) estimate that oceans might rise by 0.55m to 0.85m by the end of the century, which could easily swallow up the Maldives and many of the Polynesian atolls. But other effects are less well known.

Take, for example, permafrost, which covers around 24% of the land surface in the northern hemisphere. The fact that it is permanently frozen (hence the name permafrost) means that it is waterproof. Researchers have calculated that unimaginable quantities of toxic substances are trapped within its masses, including more than 1,600 million kilogrammes of mercury, as well as huge quantities of methane and sulphuric acid. This worrying amount of pollutants could seriously contaminate the oceans, if the poles melt.

Growing awareness

For a long time now, environmental associations have denounced the most polluting sectors for their impact on our planet. Nowadays, sovereign states and supranational organisations are jumping on the bandwagon. 2015 was a year of awakening: the United National created 17 “sustainable development objectives”, while 196 states signed the Paris Agreement on climate change, known as “COP21”, and France passed a law on transitioning to greener energy. Consumers are increasingly ramping up the pressure on companies too.

Look at the recent example set by Shelby O’Neil: at only 17 years of age, this young woman has already managed to convince several companies, starting with Alaska Airlines, to ban the use of plastic straws, which are a known hazard for marine life. In 2015, a handful of students at the University of Columbia launched an initiative that, in February 2017, eventually convinced this prestigious institution to divest from the coal industry. The Rise for Climate protests, on 8 September 2018, occurred in nearly a hundred countries worldwide, testifies to a global movement ready to stand up for the slogan held aloft in the demonstrations in Marseilles: “Be the change you wish to see in the world.” This change will accelerate if the action in favour of a new model has a broad support base, encompassing civil society, nations, consumers and, of course, investors.

[…]change will accelerate if the action in favour of a new model has a broad support base, encompassing civil society, nations, consumers and, of course, investors.

Finance must serve the interests of humankind

In his preface to a recent book by Bertrand Badré, the former Managing Director of the World Bank and founder of Blue Like An Orange Sustainable Capital, French President, Emmanuel Macron, points out, “Finance is only a means of serving people’s needs. Finance should be serving us – we shouldn’t be serving finance.” And indeed, the most effective means of quickly prodding companies into changing their ways is via financial institutions, which are able to grasp the link between ecological and economic risk and can nudge the companies they co-own into altering their strategies.

Article 173 of the French Energy Transition Law also brings large French investors (insurers, pension funds) on board. It forces them to explain publicly, every year, if and how, they are aligning their investments in order to tackle global warming. This encourages them to exert pressure on the companies in which they invest and to demand more and more details about the environmental impact of their activity. Investors can also follow the example of Norway’s sovereign wealth fund, which manages around 900 billion euros in accordance with strict ethical criteria. It regularly excludes companies from its investment portfolio. In 2017, for example, it divested holdings in 11 companies, mainly because of their involvement in coal production. Large companies are more inclined to listen to equally powerful investors.

But the role of investors is not just to manage risks. These “guardians” of the world’s savings, which have never been so abundant, need to consider the opportunities opening up […]

But the role of investors is not just to manage risks. These “guardians” of the world’s savings, which have never been so abundant, need to consider the opportunities opening up: they can direct capital towards companies that offer practical environmental solutions, which will be the source of tomorrow’s profits – and they can understand the needs of tomorrow’s savers, generation Y, who need a sense of meaning as much as they need to finance their pensions.

Everyone – companies, countries, NGOs, investors and individuals alike – must face up to this common challenge: the need to ensure that our beautiful planet remains inhabitable for us all.

Biography

Emmanuel Schafroth has been a financial journalist for 18 years. He has covered many sectors, including technology, renewable energy, asset management and sustainable finance. He is now self-employed and collaborates with various newspapers, including the French daily newspapers "Le Monde" and "Les Echos".

Please note that Emmanuel Schafroth views and opinions are his own and not necessarily a reflection of those of the Lombard Odier Group.

share.