investment insights

Cautiously optimistic, despite political and economic risks

In a nutshell

- With risk assets now more sensitive to macroeconomic factors, such as monetary policies and normalising inflation, and political uncertainty playing an increasing role, volatility in market sentiment is here to stay.

- Nonetheless, we see reasons to remain cautiously optimistic: 2019 will begin with more favourable valuations and still sound fundamentals. And US monetary policy, while approaching neutrality, is unlikely to take a restrictive turn in the short-term.

- The current level of real rates justifies a more neutral, but not risk averse, portfolio positioning.

- Keeping in mind that investment discipline and strengthened risk management are key at this stage of the cycle, asset quality and liquidity are the foremost considerations. As such, we favour equities over high beta fixed income segments, maintain above-average cash holdings and are starting to opportunistically reduce our long-held underweight in sovereign bonds.

- We highlight two major risks to our scenario: an overheating of the US economy that would force the Fed to accelerate its hiking cycle and a full-blown trade war accompanied by heightened geopolitical tensions. Recent Fed comments and the outcome of the US-China meeting at the G20 summit suggest that these risks have abated somewhat near-term, but they will likely continue to drive investor sentiment throughout 2019.

The latter phase of an expansionary cycle poses specific challenges for investors, who must gear up for lower and more volatile returns across the board. Market corrections can occur without recessions, as valuations adapt to a higher rate environment, but they tend to be short-lived and losses are generally recouped in the following months. 2018 was marked by two such major volatility episodes, in February and in October-November (see chart 10, page 10) – three when taking into account the summer emerging rout. Markets reacted to strong US macroeconomic data by materially re-pricing interest rates, driving nominal and real yields to multi-year highs. There was nowhere to hide, with the correlation between equities and bonds notably becoming less negative. Through mid-October, commodities did provide some diversification, supported by a supply-driven energy sector, but, at the time of writing, all asset classes are headed for flat or negative annual total returns (see chart 11, page 10).

To navigate this troubled 2018 environment, we have been very selective and prudent with respect to our risk exposure. At this point in the cycle, we believe the main indicator to monitor is the level of real rates versus potential US growth. Indeed, continued monetary policy tightening increases the risk of financial market accidents, as the most vulnerable economic actors find themselves challenged by the rising cost of capital. Begun in June, our process of risk reduction has been gradual and focused on the least liquid assets. Positions in emerging debt in local and hard currencies as well as convertible bonds have been cut, effectively reducing exposure to the high yield segment.

To navigate this troubled 2018 environment, we have been very selective and prudent with respect to our risk exposure. At this point in the cycle, we believe the main indicator to monitor is the level of real rates versus potential US growth.

These actions have reinforced our ability to act nimbly under any market conditions. Asset liquidity helps us adjust risk exposure amid rising uncertainty while higher cash holdings allow us to selectively seize tactical opportunities as they arise. Indeed, we see at least three reasons to embrace the coming year with a cautiously optimistic stance.

First, the good news is that we will enter 2019 with more favourable valuations and investor positioning. Asset valuations have adjusted down, sometimes very abruptly. For instance, 2018 saw the S&P 500 index undergo its 3rd largest multiple contraction in 40 years, despite stellar earnings growth. In addition, crowded trades, such as US technology, have been unwound.

Second, fundamentals remain solid. Global growth will decelerate, and corporate profits may have peaked in the US but still offer a decent outlook. Our analysis calls for US earnings to grow in line with their long-term average (see chart 12, page11) based on (i) stable sales growth (ca. 8% as we expect a weaker USD to offset slower nominal growth); (ii) continued strong buyback activity, with company balance sheets still being cash-rich; and (iii) some downside risk on margins as input costs are increasing and additional tariffs cannot be ruled out, but of limited amplitude. These estimates are quite close to consensus expectations which, interestingly, were not meaningful revised down during the latest volatility episode.

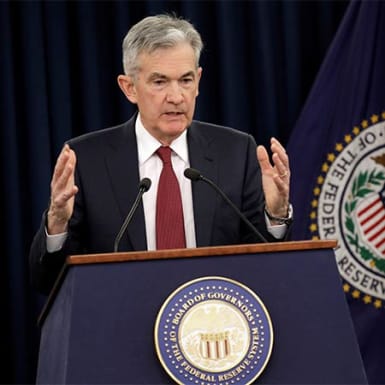

Finally, but very importantly, with markets having paid the price of Fed hiking in 2018, some reversal may occur. A number of Fed Committee members, including Chairman Powell, have acknowledged that the policy rate is now close to the neutral level, meaning that a more flexible Fed stance is likely going forward. Market expectations of US monetary tightening should thus be more data-dependent, reducing the risk of a surge in real rates in the short-term. In our view, the current level of these rates, still well below estimated potential US growth, warrants a neutral, not risk averse, portfolio positioning (see chart 13, page 11).

In terms of asset class preferences, we continue to favour equities. At this stage of the cycle, we believe that high beta fixed income segments are more sensitive to the level of rates, as well as possibly suffering from illiquidity. Since the beginning of the year, the financing cost for a high yield issuer has risen by more than 130 bp to 7.40% (respectively +230 bp and 6.61% for investment grade emerging corporate debt) and credit quality is about to deteriorate consequently, suggesting a rise in idiosyncratic risk (see chart 14, page 12). We thus remain underweight credit and hold no high yield bonds. Conversely, we believe that equities are less at risk with valuations having adapted to the current level of rates and corporate profitability unlikely to suffer so long as real rates remain below potential growth.

From a regional viewpoint, Eurozone, Japanese and emerging markets continue to look cheap (see chart 15, page 12) but we see little chance of a significant re-rating outside of the US and are thus making no change to our allocation. At this point, we favour the Japanese market on relative valuation, rising capex spending, positive market reforms and absence of political risk. More tactically, following the positive outcome of the G20 summit, we recently added some exposure to emerging equity markets as we expect the temporary truce in the US-China dispute to lead to some reduction of trade-related risk premia and support investor sentiment.

While history shows that maturing economic expansions can offer decent returns, they also bring about palpable risks. The two major ones that we would highlight are an overheating of the US economy… and a full-blown trade war accompanied by heightened geopolitical tensions across the globe.

Our sovereign bond positioning differs according to portfolios’ base currency. In USD portfolios, we have gradually bought into sovereign bonds as yields began to look attractive. We were careful to maintain a rather short duration, while balancing the exposure between nominal and inflation-linked bonds so as to preserve capital in the event of a rise in inflation and/or an acceleration of Fed hiking. Following these moves, our sovereign bond exposure is now neutral in USD portfolios, while still underweight in their European counterparts. We have nonetheless tactically reduced our long-held underweight of EUR sovereign bonds to take advantage of markets’ exaggerated pricing of Italian political risk. With consensus expectations of the upcoming ECB tightening cycle in line with ours, we found the pick-up in yield and the roll-down offered by the steep Italian curve particularly attractive.

While history shows that maturing economic expansions can offer decent returns, they also bring about palpable risks. The two major ones that we would highlight are an overheating of the US economy, that would force the Fed to shift from a gradual and flexible pace to an accelerated hiking cycle, and a full-blown trade war accompanied by heightened geopolitical tensions across the globe. Given the lack of buffer provided by government bonds, we seek diversification and hedging strategies beyond this traditional safe haven, especially in European portfolios. In the currency space, we have tactically deployed hedging strategies, buying the Japanese yen first against the euro and now against the USD, to provide some cushion during volatility episodes. We also believe that having diversified exposure to commodities remains appropriate in this late-cycle environment and provides an interesting asymmetry to multi-asset portfolios. Current price levels do not reflect tight supply-demand balances, with potential upside notably in oil and base metals in our baseline scenario (we still forecast Brent at USD 75 per barrel on a 12-month horizon). In the event of an escalating trade war and/or rising geopolitical tensions in the Middle East, the upside on gold and/or oil would obviously be meaningful. And were the US-China trade dispute to be resolved, base metal prices should outperform markedly. Finally, we took advantage of a technically-driven episode of volatility in the Swiss real estate market to strengthen our exposure to this asset class, which in our view still exhibits sound fundamentals and attractivity in the low yield environment.

Important information

This document is issued by Bank Lombard Odier & Co Ltd or an entity of the Group (hereinafter “Lombard Odier”). It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful to address such a document. This document was not prepared by the Financial Research Department of Lombard Odier.

Read more.

share.