Just four years ago, relatively few people had heard of the appetite-regulating hormone ‘glucagon-like peptide-1’. Today, GLP-1, as it is more commonly known, is a household name, after drugs that mimic its effect were found to be remarkably effective in aiding weight loss.

A growing range of these drugs – including major names such as Wegovy, Zepbound and Mounjaro – is already disrupting the weight loss industry. As they do, insurers are scrambling to analyse the long-term implications for the wider healthcare sector. The question is not merely whether GLP-1s should be available through health insurance, but of what the impact will be from their widespread uptake. To what extent will they reduce the morbidities that often accompany obesity, such as heart disease and diabetes? Could they lead to longer lifespans? And, if they do, will these be healthier lives, or will more years also mean more health interventions?

Today, health insurance is just one of a number of sectors facing disruption and uncertainty. Real estate and property insurers, for instance, are having to deal with rapidly escalating payouts from extreme weather events, leading some to reduce coverage to regions most vulnerable from climate catastrophes. Artificial intelligence (AI) is also creating a major unknown, with the potential for new and broadening avenues of cyber fraud.

Our economic and social systems are changing, presenting insurers with unprecedented challenges. As we move from a world of quantifiable risk to hard-to-measure uncertainty, we take a look at how insurers are responding, and what the impact is likely to be for investors and the wider economy.

The end of obesity?

In May 2025, WeightWatchers filed for bankruptcy. For many decades a fixture in the highly profitable weight loss market, the firm blamed competition from weight loss apps and the sudden availability of GLP-1 drugs. A pivotal moment came when talk show host Oprah Winfrey, then a major WeightWatchers shareholder, stepped down from the board and announced she would give away her WeightWatchers shares after acknowledging that her own dramatic weight loss had been achieved with the help of GLP-1s.

In the US, around 40% of the population is obese1, a four-fold rise since 19602 – many are now wondering if the end of the obesity epidemic could be in sight. Despite Wegovy, also known as Ozempic, only being approved for use as a weight loss drug by the US Food and Drug Administration as recently as June 2021, it’s thought that around 6% of Americans – 15 million people – currently have a prescription for GLP-1s, while as many as one in eight may have tried them at some point.3 Around the world, it is anticipated that the market for GLP-1s could be worth more than USD 471 billion by 20324.

As GLP-1s have exploded in popularity, a rich dataset of studies has grown up around their use. It is now known, for example, that as these new drugs help patients lose weight, they also reduce the risk of heart failure hospitalisations, stroke, obesity-related cancers and kidney failure by anywhere from 7%-21%, and can cut all-cause mortality by around 12%.5

These wide benefits could force insurers to re-write the assumptions on which their risk models are built. According to reinsurance firm Gallagher Re, GLP-1 drugs alone could add 1% to 2% to annual medical spend in the US in the short term, but “their potential to reduce the burden of chronic diseases could lead to significant long-term savings”.6

Much remains unknown, however. For example, Gallagher Re highlights that medical risk experts are divided on whether GLP-1s will drive a reduction in elective surgeries such as joint replacements, as weight loss reduces the load on joints; or an uptick as more people become eligible for surgery due to having a lower BMI. With GLP-1s still in their early days, insurers may have to alter their underwriting guidelines as the full picture becomes clear.

Read also: Future-proof | Lombard Odier

AI and cybersecurity

The extraordinary rise of GLP-1s is mirrored by the explosion of generative AI. With ChatGPT’s launch in November 2022, the ecosystem of generative AI tools has grown even more quickly than GLP-1 medication, and could have a still larger impact on society. Similarly, for insurers, AI represents an unknown disruption – one that could transform the cyber insurance landscape.

According to Lloyds, AI is likely to lead to an increase in low-level cyber losses, with AI models able to target human weak points more effectively through impersonation or phishing, to adapt attacks to evade detection for longer, and to reach a broader audience due to the lower cost of target selection.7 In response, German insurance giants Allianz note that the cyber insurance market is expected to double in size over the next few years, to reach nearly USD 30 billion.8

The long-term implications for insurers remain uncertain, however. Just as AI poses a threat, it could also be harnessed by businesses to spot cyber-attacks early – industry forecasts suggest that cyber security AI spending could reach USD 46.3 billion by 20279. For Rishi Baviskar, Global Head of Cyber Risk Consulting at Allianz Commercial, “AI is set to redefine the insurance industry. […] Insurers must adapt to emerging AI-specific threats, evolving regulations, and the shift towards proactive risk mitigation.”

Read also: Rethink Perspectives: AI and the new world order | Lombard Odier

Climate change forces risk rethink

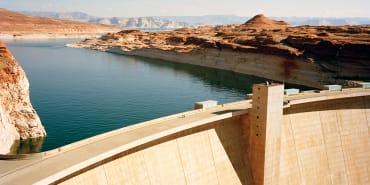

Insurers in the real estate sector are also facing an unprecedented and escalating challenge. Forty years ago, the total global financial loss from extreme weather events and climate disasters was USD 9.19 billion10 – by last year that had risen to USD 320 billion11. Meanwhile in the UK, property insurance payouts have reached a 20-year high12.

Extreme weather is now a material risk for insurers, who are being forced to rethink their risk models. For businesses, political policymakers and investors, the ultimate threat is that insurers will reduce the availability of coverage. In parts of the US, this is already happening. Throughout 2022 and 2023, State Farm, the US’s largest home insurer, allowed tens of thousands of policies to lapse, and paused new business in California, after suffering losses of more than USD 12 billion due to extreme weather.13

In Europe, after the worst wildfire season on record in 202514, industry analysts said, “Wildfire risk across southern Europe has shifted from a sporadic, ‘secondary’ peril to a structurally material driver of earnings volatility […]. Record-hot summers, longer-than-usual fire seasons, and expanding wildland-urban interfaces are pushing loss frequency and tail severity higher.”

Regulators are warning that banks and even governments may begin to struggle as insurance costs soar. According to the Financial Stability Board, the watchdog set up by the G20 nations, banks could begin to cut their lending to homes and businesses deemed most vulnerable, and government borrowing costs could rise. In the worst case scenario, markets could panic as they realise they have underpriced the gravity of the climate threat.

Read also: Predicting the flame: how AI is reshaping our response to wildfires | Lombard Odier

Building resilience – from reactive to proactive

At Lombard Odier, we believe the uncertainties being experienced by the insurance industry are a result of fundamental system changes taking place across economies and wider society.

We believe that pain points – such as the escalating impacts of climate change; increasingly unaffordable healthcare systems; and a tsunami of digital innovations – are forcing business models to adapt. For insurers, this means a fundamental shift from reactive policies to proactive risk mitigation, working with customers to build resilience to today’s uncertainties.

In the healthcare sector, for example, UK-based health insurance firm Vitality has a long-established collaborative approach to encouraging its customers to adopt healthier lifestyles, including a reduced insurance excess for customers who exercise regularly. Now the firm is taking a similarly proactive approach to GLP-1s, offering the drugs at a discount in combination with coaching from a dietitian to improve adherence and help to maintain a healthy weight after the course of medication is complete. Across the health sector, we are convinced a proactive approach by insurers will be part of the transition away from today’s ‘sick-care’ model – where symptoms are treated as they arise – towards a prevention-first healthcare model that improves accessibility and achieves longer ‘healthspans’.

In the real estate sector, while some insurers may reduce coverage in vulnerable regions, others will take a proactive approach, making coverage contingent on up-front risk mitigation or offering incentive schemes. In the US state of Alabama, for instance, the FORTIFIED roofs scheme offers insurance discounts – supported by state-level grants – to homeowners who have adapted their homes to the required standard. Following Hurricane Sally, which hit Alabama in 2020, studies showed that FORTIFIED homes were subject to 60% lower insurance deductibles than their non-FORTIFIED neighbours. In the UK, a similar joint government and insurance industry initiative offers grants of GBP 10,000 to help flood-hit homeowners build resilience measures on top of the cost of repair work.

Just as insurers are shifting from reactivity to proactivity, we believe it is essential that investors take a proactive approach to portfolio allocation. Instead of focussing on today’s myriad short-term uncertainties, attempting to be first react to each item of ‘breaking news’, we believe investors must take a long-term view, investing to both benefit from, and accelerate, the transition to a sustainable economy.

We believe today’s many pain points are driving the shift away from our current wasteful, harmful economic model, towards one that is net zero, nature-positive, socially constructive and digitally enabled. Insurers, businesses and investors that maintain a reactive approach will soon be left behind. While those that are proactive, building resilience to today’s uncertainties while helping to drive the transition, will be the winners of tomorrow.

share.